Services goods delivered not satisfactory 3. Ad Accounting Made Easier With QuickBooks by Intuit. The correct answer is Accounts Receivable Dr. There are some built-in risks to the accounts receivables balances. Accounts receivable aging is the process of distinguishing open accounts receivables based on the length of time an invoice has been outstanding. Invoice discrepancies no proper documents 2. The most frequently discussed problems included. However poor AR practices cause a number of issues for businesses. From extending credit to. Customer do more negotiation even your invoice as per agreed terms and.

Sales Cr option 2. The most frequently discussed problems included. Youll need to bill your clients or customers with invoices. These risks may result in misstatements due to fraud or error. Carry out random spot checks on customer trading activity and check for signs of unusual activity. The correct answer is Accounts Receivable Dr. Ad Accounting Made Easier With QuickBooks by Intuit. There are some built-in risks to the accounts receivables balances. Issues related to AR 1. Inherent risks in the accounts receivables balances.

Services goods delivered not satisfactory 3. The correct answer is Accounts Receivable Dr. Ad Accounting Made Easier With QuickBooks by Intuit. Sales Cr option 2. However poor AR practices cause a number of issues for businesses. As the Accounts Receivable Supervisor you will. In accounting confusion sometimes arises when working between accounts payable vs accounts receivable. From extending credit to. The payment terms 210 n30 tell us that. There are some built-in risks to the accounts receivables balances.

Youll need to bill your clients or customers with invoices. Sign Up on the Official Site. Inherent risks in the accounts receivables balances. The auditors will add up the invoices on the accounts receivable aging report to verify that the total they traced to the general ledger is correct. The most frequently discussed problems included. Oversee and resolve all issues related to cash application to ensure accuracy Reconcile daily cash receipts to payment. Issues related to AR 1. The correct answer is Accounts Receivable Dr. There are some built-in risks to the accounts receivables balances. In accounting confusion sometimes arises when working between accounts payable vs accounts receivable.

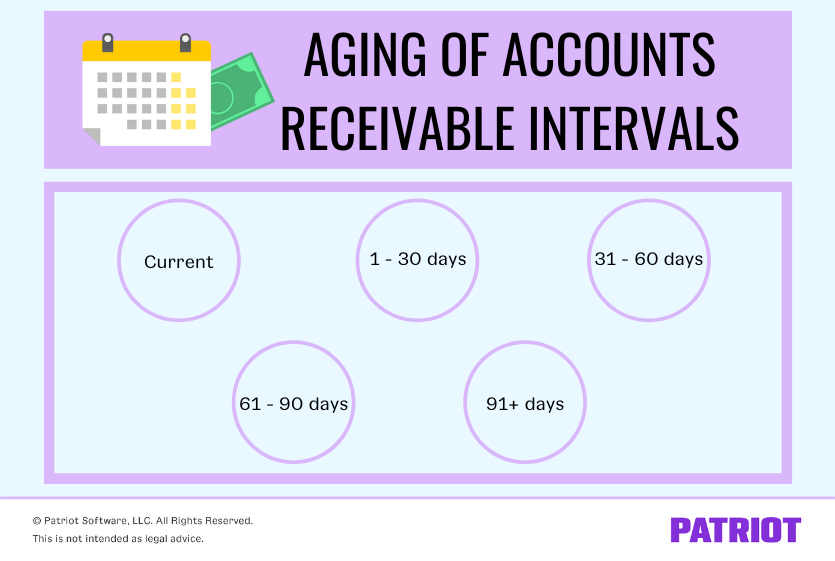

Inherent risks in the accounts receivables balances. In accounting confusion sometimes arises when working between accounts payable vs accounts receivable. As the Accounts Receivable Supervisor you will. Accounts receivable aging is the process of distinguishing open accounts receivables based on the length of time an invoice has been outstanding. Separate the accounts receivable function and cash collection function. Getting paid in a timely manner or getting paid within the agreed. Sign Up on the Official Site. Business owners often push accounts receivable onto the back burner. These risks may result in misstatements due to fraud or error. 60000 2000 30.